Pavilion, Garage & Pool House Financing

Building your dream outdoor living space or storage building is an exciting journey, and there are several great financing options to help make it a reality. One option worth exploring is reaching out to your bank or credit union to learn about their financing offers, such as home equity loans or HELOCs (home equity lines of credit). These options can provide flexible funding, with HELOCs offering a revolving line of credit that adapts to your needs.

First Tech Credit Union

Make any project affordable with a flexible, open-ended Home Equity Line of Credit from First Tech Federal Credit Union.

Benefits of funding your project with a First Tech FCU HELOC:

Financial Flexibility:

-

Increases buying power compared to a closed-end loan.

-

Funds can be used for various needs, including home improvements and additional items (e.g., furniture for around the pool).

-

No need for additional loans or credit pulls for further home projects.

Versatility and Eligibility:

-

Many homeowners with equity will be approved across a prime and near-prime credit spectrum.

-

Applicable to second homes and investment properties.

-

Possible tax deductions for interest paid.

-

No need for a traditional appraisal up to $400,000.00

Interest Rates and Payments:

-

Variable interest rates with fixed available.

-

Rates start below prime 30-year repayment period with interest-only payments options available during the 10 year draw period.

Application Process:

The application process is quick and easy. Tell your Homestead Rep that you are interested in a HELOC with First Tech FCU and they will work with you to get you started.

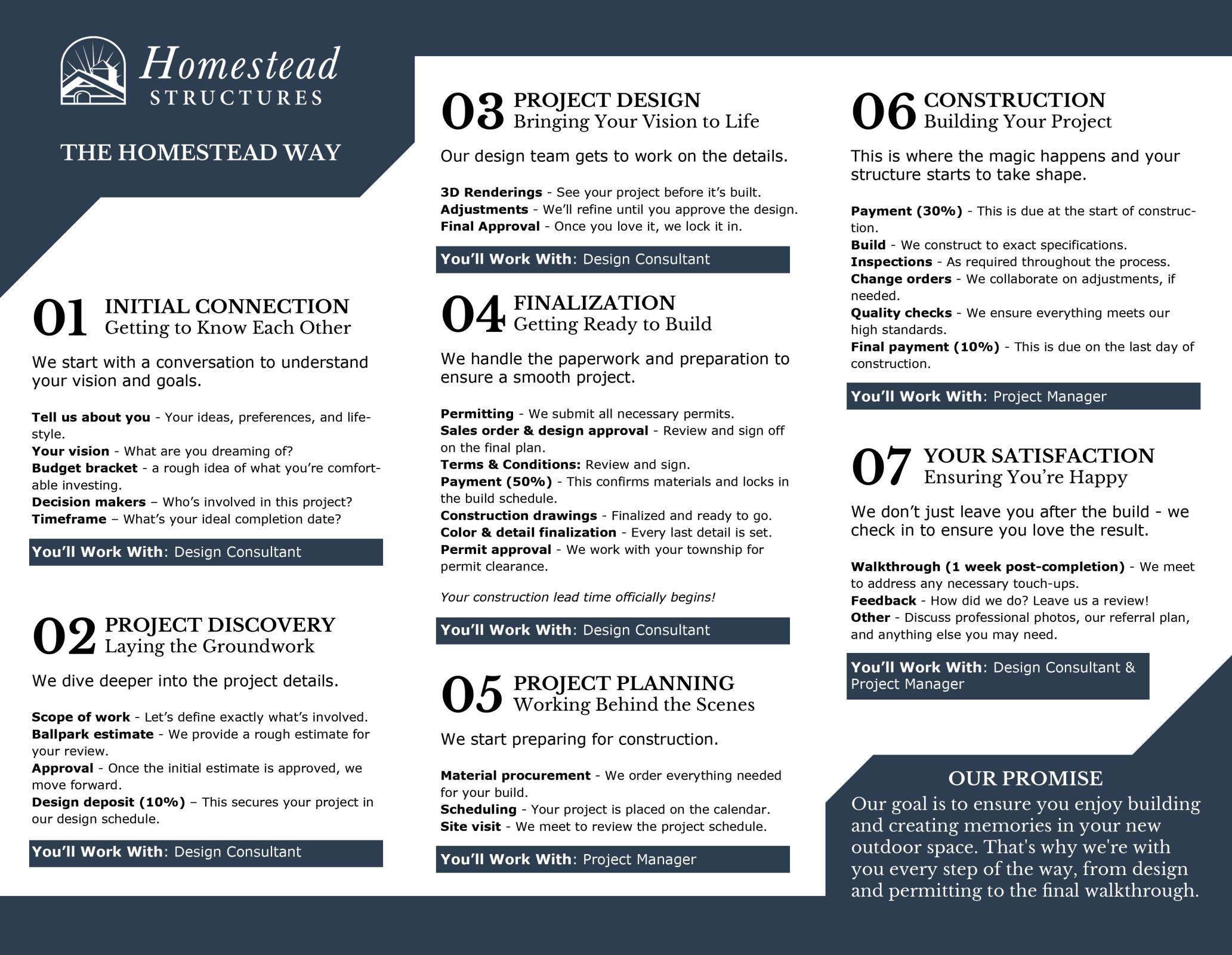

Paying for Your New Structure

Payments for your project are broken down as follows:

- 10% due at signing, which covers drawings, seals if necessary, permitting, etc. (We accept credit card payments for this payment.)

- 50% due once design is finalized to order materials, schedule the production and delivery, etc. (Credit cards are not accepted for this payment. At this stage, 60% of project should be paid).

- 30% due when unit or kit is ready to ship and be installed. (No credit card payments, 90% of project paid at this point).

- Remaining balance is due 1 day before completion of job. (No credit card payments).